Your financial sins could be costing you big time. Our blog will teach you how to fix them.

They say that mistakes are the only way to learn, and while that might be true, financial blunders are a whole different ball game. Ongoing poor money management can lead to a lack of freedom and financial stress. In fact, a 2018 study by UBank revealed that 59% of Aussies admit their current financial situation is causing them stress, while 44% of millennials fear for their financial future.

Most of the time, we don’t realise we’re committing financial sins. Read on to find out the five common money mistakes you might be making and how you can put a stop to them.

Living Beyond Your Means

With the rise of social media platforms, like Instagram, there’s never been more pressure to appear wealthier than you really are, particularly for younger Aussies. A recent poll by Finder found that almost half (47%) of Aussies feel pressure from their social circle to keep up financially. And what’s scarier is that one in five respondents confessed they were happy to go into debt to do it.

Living beyond your means like this can cause a massive strain on your budget and hurt your savings. And if you’re using credit to keep up appearances, you could also be doing some damage to your credit score.

How can I fix it?

Rather than try to follow the spending habits of others, take the time to reevaluate your financial situation. Although there’s nothing wrong with indulging every now and then, it’s important to make sure it fits well into your budget and won’t impact your financial goals. If you are having trouble with overspending, it might be worth opening a ‘fun account’, so you can indulge without hurting your budget. This is an account that is allocated for everything from nights out to online shopping to travel.

Having No Financial Plan

Whether you’re a pro or novice with managing your money, having a financial plan is essential. Setting financial goals or creating a financial plan is important for maintaining positive financial habits, as it gives you something to work towards and teaches you discipline. For example, if one of your financial goals is to save for a home loan deposit or to purchase a new car, you’re more inclined to hold yourself accountable to reach your goal.

How can I fix it?

Spend some time thinking about goals you would like to achieve, big and small. Some common examples of financial goals are to save for an emergency account, pay off debt or start your own business. Once you’ve got your goals written down, your next step is to create a plan of how you intend to reach this goal. This might look like contributing more to your savings every month or making additional repayments to pay down your debt.

If you’re stumped and are in need of financial inspiration, our Guide to Personal Financial Goals can help point you in the right direction.

Treating Credit As Cash

Some of the most common reasons Aussies own credit cards are for emergencies, to earn rewards points or to access other shopping benefits. But because these products can be used just about anywhere, many Aussies tend to go overboard with their spending and treat their credit cards like regular cash, especially when they don’t need to! According to Finder, 72% of Aussies admitted they would be able to effectively manage their finances without their credit cards.

The trouble with doing this is as you start to accrue a hefty balance, your interest bill also begins to climb. And if you’re struggling to get on top of your balance or miss monthly payments, not only might it take years to pay off your debt, credit health might also take a hit.

How can I fix it?

Make getting debt-free your top financial priority and pay more than the monthly minimum repayment. Give yourself a debt-free deadline and create a repayment plan to figure out how much you can afford to pay back every month. This might mean having to cut back in certain areas or finding ways to funnel extra cash toward your debt. Check out our credit card debt blog for more details.

It’s also important during this time to learn how to manage your finances without a credit card and establish positive financial habits, like regularly saving and sticking to your budget.

Not Investing

While regularly topping up your savings account can give your financial security, there are other ways to grow your savings, like share trading. According to Finder, almost half (49%) of Aussies now own shares, with 13% of Aussies investing for the first time during the COVID-19 pandemic. One of the benefits of investing is the potential for long term returns and the ability to continue to earn an income once you hit retirement. Now more than ever, it’s important to make your money work for you.

How can I fix it?

As investing and share trading has gained some traction over the past few years, there are a variety of resources and tools available to help you understand the stock market. A good place to start might be a micro-investing platform, as they allow you to start investing without a massive initial deposit. They’re also an easy way to understand how the stock market works and gives you the space to play around with different shares.

Of course, there are other investment options such as investment properties, investment bonds, term deposits or even peer-to-peer lending, so be sure to do your homework and choose the option that works best for your financial goals.

Not Using Any Money Apps

Between online banking to contactless payments, personal finance has taken a big digital turn, which is why savvy Aussies are opting to manage their finances with the help of apps. And if you haven’t jumped on the bandwagon yet, you might be missing out on some priceless perks.

According to UBank, 31% of Aussies said they didn’t use any money apps, but agreed that it would be a good idea. One of the benefits of using money management apps is that they often come with features that can help you reach your savings goals.

How can I fix it?

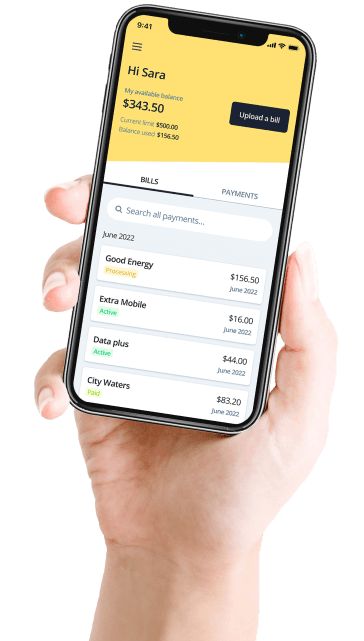

Do some research around the type of apps around to find the one that might work best for your lifestyle and your financial goals. There are a variety of apps around, from those that track your spending, help you pay off debt or even pay and manage your bills, like Deferit.

Deferit is a budgeting app that splits your bills into 4 instalments with no interest. Once you upload your bill, Deferit will pay the biller up front, meanwhile, you pay your bill back over 4 fortnightly payments. You can use the platform to pay just about any bill, from your energy bills to your car registration to medical or dental expenses.

Want more tips and tricks about effective money management? Check out the rest of our blog! We cover a range of topics from setting financial goals to guides on understanding your credit score.