No matter how prepared we are, some bills can just slip our minds. Our blog will teach you how to get better at paying bills on time.

From your insurance to your home loan and every other bill in between, running a household is no mean feat. And unfortunately, no matter how prepared we are, some bills tend to slip our minds and unfortunately, that means being hit with late payment fees. According to a 2016 survey from Commonwealth Bank, one third of Aussies paid a late bill over a period of 12 months, nationally costing us a massive $286 million in late fees!

What happens when you miss bill payments?

While it can happen to any of us, missing a bill payment brings on more than just an angry letter from your biller. Typically, a biller will give you an extra few days to pay a bill as a warning before issuing a late fee. The average late fee currently sits at $13, which might not seem like much, but if you’re regularly missing due dates, these can add up really quickly and eat into your finances.

Missing bill payments can also mean bad news for your credit health, as billers are allowed to report defaults to credit bureaus after 60 days if the bill is still unpaid. Having marks on your credit history for unpaid or late bills can reduce your credit score. A poor credit score means that lenders and other financial providers view you as a liability when you apply for a credit product, like a home loan or credit card, and can reject your application.

Here are some ways to stay on top of your bills.

How to start paying bills on time

As you’ve probably gathered by now, paying bills on time can do more for your financial well-being than just providing a happy relationship with your billers. If you’re ready to get serious about paying your bills on time, every time, we’ve got three easy tips to get you started.

Create a list of all your bill due dates

Sit down and categorise every bill you pay on a monthly, quarterly or annual basis along with their due dates. In addition to your major expenses, like your utility bills, rent or home loan repayments, it’s important also to include minor expenses. This includes things like streaming subscriptions or your gym membership.

Depending on what works best for you, you might want to physically mark the dates on a calendar, set reminders on your phone, or stick a note on the fridge. Doing this will keep you in the loop of upcoming bills and help you avoid missing future payments.

Automate certain payments

Depending on the type of bills you have, you might want to automate certain bills that don’t fluctuate in cost and are relatively minor, like subscriptions or memberships, while keeping track of other expenses yourself. It might also be worth going through your active subscriptions and cutting any you no longer need to save a few extra bucks.

While having all expenses being paid via direct debit can take some of the guesswork out of remembering due dates, it might not be the best option for your budget. Especially if your bills tend to not line up with your paycheque. That’s where our next tip comes in handy.

H3: Take advantage of digital tools

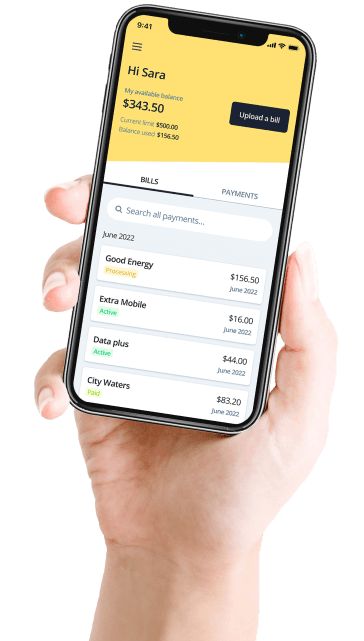

One benefit of an increasingly digital world is online money management tools. When used regularly, these apps can encourage positive money habits and put you on the right track to financial freedom. While there are various options available, from savings trackers to cashback apps, if you’re looking to keep your bill payments in check, you might want to check out Deferit.

Deferit is a budgeting app that allows you to keep track of your bills in one place and receive reminders about upcoming payments. But what makes this platform a first of its kind, is that you can defer any bill and pay it back over four instalments. Meanwhile, Deferit pays the bill in full and on the date you specify, which means you can still get your bill payment in on time, whilst enjoying the flexibility of paying over 6 weeks. Having this kind of flexibility frees up your cash flow and because there’s no interest or late fees, it’s also easy on the wallet.

Three tips to prevent late payment fees

If you do feel like you may miss an upcoming bill, it’s important to take action as soon as you can to avoid being penalised. Rather than await being hit with a late fee, here are three simple steps you can take to ensure you and your biller are on the same page.

Contact your biller

For some of us, missing bill dates has more to do with simply forgetting. Over the last few years, households have faced more financial pressure than ever before and unfortunately, that’s led to Aussies falling behind on bills. If you think you won’t be able to pay a bill on time, get in contact with your biller to explain the situation. Your biller may then either extend your bill’s due date or work with you to establish a payment plan. Not only will this give you some extra breathing room, but you’ll also avoid late fees or other penalties.

Create your own billing cycle

One of the major pain points about bills is that the due dates don’t always work with our lifestyle. For example, if a bill is due before you get paid for the month. That’s where using a service like Deferit comes in handy. Once you’ve uploaded a bill to the platform, Deferit allows you to reschedule your payment dates for free. Having this flexibility means you get to pay bills at a time that works better for you and your budget.

Go digital with your bills

How many times have you gotten a bill and put it on the counter only for it to get lost amongst other scraps of paper? As our lives continue to go more digital, it might make sense to do the same with our bills. Receiving digital copies of your bills can help keep them front of mind so you don’t miss payment dates. Many billers also charge a fee to send out paper bills, so going digital could also help you save a few bucks every year!

Want a better way to pay bills? Try Deferit! Find out how it works and pay your next bill in minutes!