Ready to boost your savings and reign in your spending? Our comprehensive guide reveals simple money hacks that can help you change your money habits.

No matter who you ask, everyone would love to have a bit more money stashed in their savings. Whether it’s in the form of an emergency fund or your regular day to day savings account, having a decent savings fund can help you get out of a sticky situation or be used as a tool to create future financial wealth, like purchasing a home.

One common misconception about saving money is that it means having to say goodbye to the things you love most, like dinners out or travel. At Deferit, we think with the right knowledge, it’s possible to have the best of both worlds.

In this article, we’ll share some easy ways to cut back on your spending as well as tools and apps that can help make saving a breeze, plus answer some commonly asked questions about keeping your savings account topped up.

Find ways you can cut your spending

If you were to take a look at your spending over the last month, how many purchases could you rule out as unnecessary? With the ease of online shopping and contactless payments, it’s not uncommon for our spending to occasionally get the better of us. But with a few simple changes and swaps in your budget, you can be well on your way to saving big.

Buy Generic Brands

When shopping for food or other essential items, it’s almost second nature to purchase brand-name items. But more often than not, this often means paying a premium on your groceries. While there might be some items you might not want to part ways with, like your favourite chocolate or tea, buying generic or home brand versions of basic products, like milk or flour is a simple way to save some coin. The good news is, generic options often are quite similar to branded products, so you might not even notice the difference!

Compare your Service Providers

When it comes to our personal finances, a lot of us tend to approach it with a ‘set and forget’ mentality. But this line of thinking could be costing you! If it’s been a while since you took out your home loan, insurance policy or energy deal, you might be missing out on a better deal. Sit down and go through all your financial responsibilities, comparing them to current offers on the market. And if you happen to find a cheaper alternative, why not make the switch?

Reduce your coffee intake

Picking up a takeaway coffee has become a daily habit for almost everyone. But our daily pick me up could be costing a small fortune. According to insurer RACQ, Queenslanders alone are spending just over $1,600 a year on coffee! Of course, kicking a habit as good as barista brewed coffee is difficult, so rather than going cold turkey, try to reduce your coffee consumption in a way that’s realistic for you. This might look like only purchasing takeaway coffee 3 times a week. Or if you’re guilty of buying multiple coffees a day, switch things up by only buying one while brewing the rest yourself.

Purchase second hand where you can

If you’re in the market for a new side table or kitchen appliance, why not jump online to see if you can pick one up second hand? Resources like Gumtree or Facebook Marketplace, are filled with a range of second hand items more than often in practically new or great condition. This will not only help you save a few bucks on your next purchase, but it’s also a great way to do your bit for the planet!

Another quick way to add a few extra dollars to your savings account is to join in on the fun and sell your own unwanted items online. According to a 2020 report by Gumtree, the average Aussie household is sitting on a massive $5,800 in second hand items! This could be anything from clothes you no longer wear to old books, gardening tools and other equipment you have lying around the house.

Automate Paychecks to Generate Savings

For a lot of us, the challenge with regularly saving is remembering to do it in the first place! This often happens when direct debits are set up to take care of immediate and important expenses, like mortgage or rent payments, while the rest gets spent accordingly over the month. Take the hassle out of saving by automating your savings via your banking app or online account. This way, when your monthly salary gets deposited into your account, a nominated amount will automatically be moved across into your savings account.

Create a budget

Making the effort to prioritise saving while spending less often starts with a budget. Following a budget will give you a clear outline of your cash flow and help you set and meet your savings and spending goals and keep you from overspending. Having a budget in place can also hold you accountable to save, as you’ll be allocating a calculated amount to be put away.

If you’ve never created a budget before and are unsure of where to start, work out your monthly salary sift through your most recent bank statements and calculate how much on average you spend a month. From there, you will be able to determine how much of your spending can be reduced and put toward more important areas, like your savings.

Put a spending limit on your card

Sometimes the best way to reign in our spending is to cut things off at the source. Many banks or card providers offer the option to set spending caps on debit or credit cards. You can set this up by jumping into your banking app or getting in touch with your bank.

Depending on your provider, this could be daily, weekly or monthly spending limits. Not only is it a simple way to keep your spending from going overboard, but it will also teach you how to stretch your money further and avoid impulse spending.

Use Money Saving Apps

From apps that round up your spending to digital calculators that create savings goals for you, the internet is filled with a range of online tools that make money management a piece of cake. The trick is to find the one that best suits your financial needs.

For instance, digital money saving calculators are a great way of understanding exactly how much you need to save to achieve your goals. The Savings Goal Calculator by Money Smart can tell you much you’ll need to contribute each month to achieve your goals, plus an estimate on how long it could take. On the other hand, the Wisr app rounds up every purchase to the nearest dollar and puts it toward your debt.

Cut unnecessary fees with Deferit

Most of the time, saving a few extra bucks means saying goodbye to unnecessary fees and penalties, like for instance, with our bills. Aussies across the country are currently losing hundreds of thousands of dollars every year to fees and penalties charged by their billers.

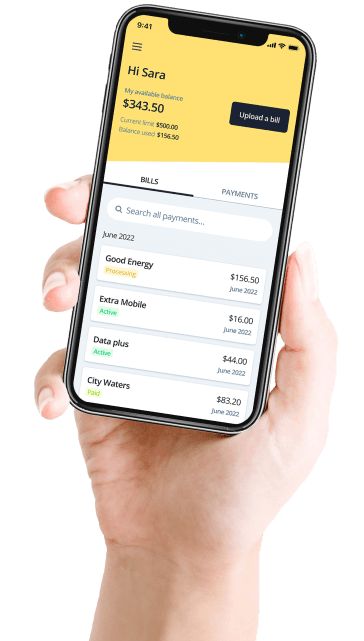

Deferit is the latest way to pay any bill, from your energy bill to childcare fees. Customers can upload a photo of just about any bill and the platform will split it into 4 smaller payments, meanwhile, Deferit pays the biller upfront and in full.

What makes Deferit different from other pay in 4 services is that it charges zero interest. Plus, users can reschedule payment dates for free, earn a balance of up to $2,000 to pay bills and only pay the flat monthly account fee when they’re using the service.

This way, you can rest easy knowing that every bill you upload to Deferit will be paid on time and you’ll never be out of pocket from unnecessary charges.

How to Save Money FAQs

Between setting up savings accounts to staying on track with different spending limits, effective money management can be a challenge for anyone. But for those who struggle with regular impulse spending or find it difficult to save with a low income, things can get even more trickier.

To get you on the right track, we’ve shared some helpful suggestions on how you can still make healthy contributions to your savings with a low income.

How to save money on a low income

Saving money can be a challenge for anyone, let alone someone who has a low income. But that doesn’t mean it’s impossible, you just need to get creative. Before you do this though, don’t forget to set up a budget first so you’re aware of exactly how much money you contribute toward savings, your essential expenses and other financial obligations you might have.

Some common ways you boost your savings while on a low income are:

- Unsubscribe from any services you don’t really need

- Sell items no longer use

- Pick up a side hustle to earn some extra cash

- Find free entertainment

- Set yourself spending limits for things like groceries, alcohol and nights out

- Stock up on cheap ingredients, like lentils, beans pasta and rice and get creative in the kitchen

What is the 30-day rule?

If you’ve spent some time researching ways to cut back on impulse spending, you might have come across something called the 30-day rule. This is a trick to help you figure out your wants and needs. Let’s say you come across an item when shopping you think you need. Rather than rushing to the counter, walk away and wait 30 days. Once the 30 days are up, revisit the item and ask yourself if you still need it. You might come to find you had completely forgotten about it or decide you don’t need it, helping you save on unnecessary expenses.

Of course, there are alternative methods to this rule, such as the 24-hour rule. This works the exact same way, the only difference is to put 24 hours between you and your spending.

Ready to kickstart your journey toward financial freedom? Download the Deferit app and upload your first bill today!