Responsible Budgeting

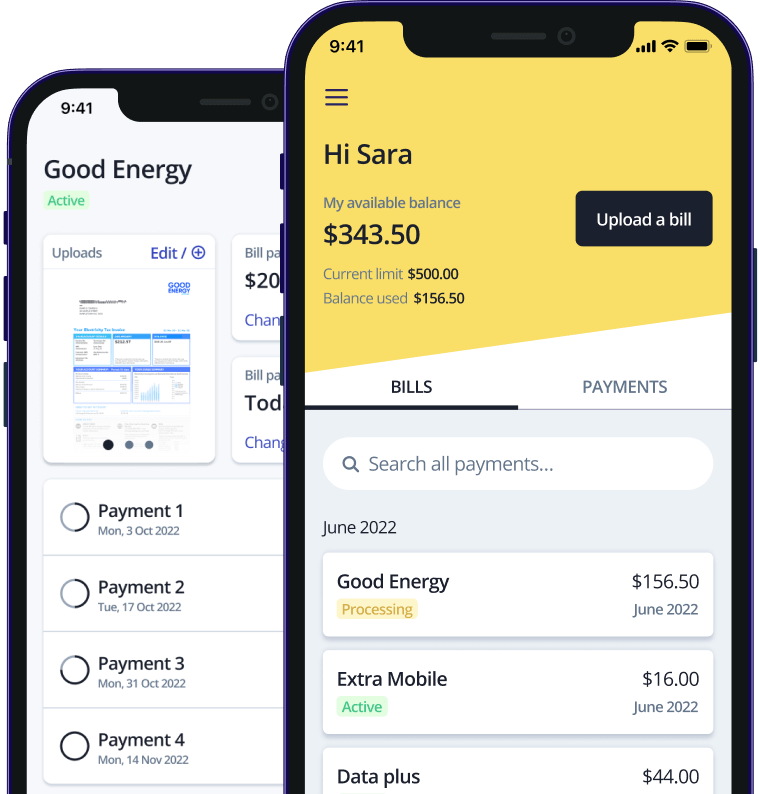

Deferit is a budgeting solution that allows people to pay any bill in 4 simple instalments. It was founded to champion the customer’s best interests when it comes to paying bills. That’s why there’s no interest, establishment fees, or annual fees on the platform. Our primary objective is to help people pay their bills and become smarter budgeters.

We recognise the responsibility of what we do, the importance of ensuring our service is appropriate to your circumstances, and the need for always being up to date on our customers’ unique personal situations.

The below principles and standards are how we communicate, interact and treat our customers.

Before using our service

Our service was created as a tool for managing personal finances. As every tool, it should always be used in the appropriate circumstances. If you are having difficulty meeting your bill payment, we recommend you contact your biller to ask what options they may have available for you. Many billers offer arrangements where they can help you with your financial circumstances.

When using our service

We take steps to verify your circumstances and check whether Deferit is able to be made available to you. We ask for some necessary information in order to verify your identity and assess your suitability to make payments. In some instances, we may require you to provide additional information to help us make an informed decision.

We get to know you over time by the types of bills you upload and the way you make and manage your payments with us. While we are still getting to know you, we may limit the number of bills you can upload and defer at any one time to ensure you meet our budgeting requirements. Once we’ve gotten to know you, your account is fully available for whenever you need.

Unlike a credit card or traditional finance, if you are late on a payment you will be unable to upload any further bills until your payment is remedied. This goes to our core in promoting responsible budgeting and wanting to ensure the platform remains relevant and appropriate for you.

Being flexible

We’re a bill payment and budgeting tool, and we designed Deferit to let you set your payments to meet your lifestyle. You can move any of your payments at no cost and there are no early payment fees. We’ll never charge you any interest either, that’s just not our style. When you make payments on your Deferit bill, you free up your balance to use towards other bills too.

If life’s been unpredictable lately, we’re here to help you get back in control. If you need to move your payments further, can’t make the monthly fee, or if you’re facing financial difficulties, get in touch with us right away so we can help. We have multiple options available including our own hardship plan and will work together to find the best solution for you.

Being in the know

Transparency is important as we’d never want you to be surprised about anything that’s happening with your account. We keep you up to date with what’s happening with your bill and we send payment reminders so you always know when a payment to us is coming up. This also gives you time to move a payment if you need.

Being safe

Safety comes first. We take many steps when verifying your account to ensure it’s set up correctly and that it accurately reflects your personal profile. We monitor all actively to make sure your account stays secure and if we see something suspicious, we may put a temporary hold on your account and ask you to get in touch with us to verify everything’s in order.

Being aware

Most billers must provide consumers with support by law. The Australian Energy Regulator has many helpful resources that explain what options are available. Deferit supports the AER and energy providers in their efforts, further information can be found at the AER’s Energy Made Easy website.

There are lots of free tools, resources and information available to help with managing your finances and budgeting. Some of the ones we recommend are:

ASIC’s money smart has loads of free, independent guidance and information so you can make the most of your money. They also have information on Financial counselling which is a free service offered by community organisations, community legal centres and some government agencies. These financial counsellors might be able to help you if you are having money problems.

The National Debt Line is a not-for-profit service that helps people in tackling any debt problems they may have.

Choice, Australia’s leading independent consumer advocacy group, offers unbiased advice and comparisons of financial products.