Why Use Deferit?

Deferit was created to help Aussies budget better and provide an innovative solution for more flexible and easier bill management. To date, we’ve helped customers save more than $19 million in late fees from over $250 million worth of bills paid through Deferit.

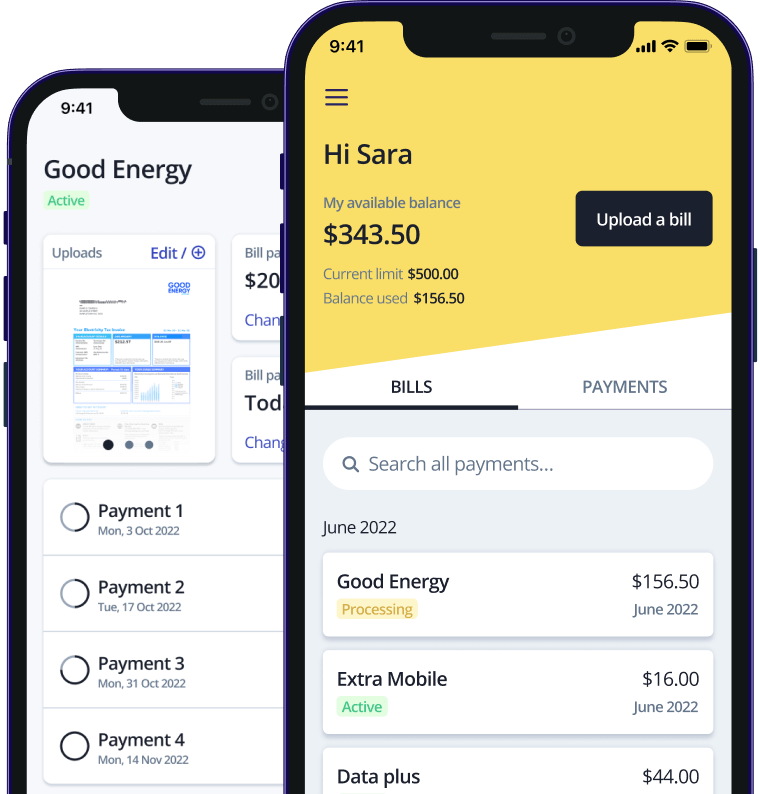

Customers love us as their ongoing bill budgeting tool, with over 74% of our customers using us for more than one bill. Instead of juggling multiple biller systems and call centres, our customers prefer the independence they get from managing their bills in one convenient location, with flexible due dates. This flexibility brings control, allowing customers to bridge the gap between irregular income & everyday expenses by choosing who to pay and when.

We’re reinforcing positive budgeting behaviour and saving people money in the process.

Deferit is transparent & risk free.

We pride ourselves on being one of the most transparent and completely risk free payment providers in the market. Deferit will never charge interest, late fees, credit report or sell customer debt.

Our mission is to help people manage their financial obligations for day to day services like energy, insurance and telecommunications among others. This is why we don’t support any discretionary purchases (like retail stuff) that could create debt and leave people in a worse financial position.

In line with our mission, we offer transparent pricing with a simple monthly fee and a small card processing charge for instalment debits. We only charge our fee when our service is in active use. No bills, no fee!

We run a credit enquiry to ensure the service is suitable for customers.

Deferit is not like your ordinary BNPL.

Deferit doesn’t increase debt for the consumer - we only deal with bills that are non-discretionary in nature. Bills are an essential good and already owed, and therefore, we are purely helping service and better manage them. If a consumer has a bill (such as an energy or water bill), it is a pre-existing obligation which has to be paid. As such, we do not contribute to debt creation or encourage excess spending when the customer may not need or require the item they are purchasing.

Traditional finance providers are under no obligation to assess the suitability of the transactions the customer is entering into today, even when currently paying off balances accruing high interest charges. These products only assess suitability at the time of application (which can be years before) and not when entering into the transaction.

We assess the suitability of our users in relation to each specific bill they defer. We’re on a mission to stop consumers falling into debt traps, paying interest, annual fees and late fees on such traditional products.

Why customers use Deferit instead of biller payment plans.

Deferit is not a replacement for in-house payment arrangements offered by some providers.

Deferit’s customers love us for taking the hassle out of bills. Whilst biller payment plans may be convenient for budgeting one type of bill, Deferit offers customers complete control and management of all their bill budgeting in one digital location.

We’ve found some customers simply won’t engage with their billers for a variety of reasons. Managing many and varied payment plans is time consuming and at times stressful for the customer, while others feel a level of pride or embarrassment to ask for help. That’s where Deferit fits - we are completely non-judgemental and understand everyone has unique circumstances. Customers can avoid calling up billers and are able to freely set their own payment dates, track payment statuses anywhere, anytime, via our seamless digital platform.

Deferit and biller hardship programs.

Deferit’s customer base have exceptional positive payment habits and are often able to pay their billers earlier than before they were using Deferit. When a new customer submits a bill, If we detect signs of hardship we won’t proceed with the bill and instead refer the customer to contact their provider for assistance through their hardship policy. We encourage customers to interact with their bill providers because they may not be aware such an avenue exists. We advocate hardship solutions offered by billers and have a responsible budgeting code of conduct.

Traditional finance solutions (such as credit cards and personal loans) can obfuscate hardship from billers with the debt able to revolve while outstanding balances accrue interest. Deferit, on the other hand, assesses payments on a per-bill basis ensuring our customers are never given more than they can afford.

Deferit isn’t a product for people in financial hardship.

Whilst we strive to identify signs of hardship prior to usage, inevitably a small portion of customers find it difficult to pay back Deferit on time. Deferit is in a unique position to proactively alert our partners if we detect this type of payment behaviour (where we have a relationship with billers).

If a customer is behind on a payment they are unable to defer further bills. The account is paused as soon as any of their instalment payments are missed, preventing people from ‘kicking the can down the road’.

Deferit helps customers become better budgeters. This shines through in how customers use our platform; those who upload an overdue bill, more than half will pay their next on time. Additionally, the vast majority of our customers will engage with their bills like never before and exhibit true budgeting behaviour- rescheduling repayments to juggle numerous expenses against their income cycle. Ultimately, Deferit is a way for customers to be in control of their finances based on their own unique circumstances.

The difference between Deferit and Bill Smoothing.

Bill smoothing in electricity requires the customer to make forward payments against an estimate of usage - which often leads to a ’true up’ payment at a later point in time. Using Deferit allows people to pay their bill based on its actual usage and know the full final cost up front. We’ve heard of negative experiences as a result of customers using bill smoothing solutions when the ’true up’ occurs, often resulting in them needing to pay an unexpected difference that they haven’t budgeted for.

What’s more, customers on these programs still aren’t able to easily move payments if an unexpected life event happens and are subsequently left without a solution to budget for those payments. Deferit gives customers complete control, security and flexibility, when they need it most.