Discover 6 proven methods to get help paying bills and reduce your monthly expenses.

When unexpected financial hurdles strike, knowing where to get help paying bills can make all the difference. You’re not alone. There are numerous bill assistance programs and strategies available to help you reduce your monthly expenses and regain financial stability.

1. Government Bill Assistance Programs

Government assistance programs provide essential help paying bills for low-income households. The Low-Income Home Energy Assistance Program[1] (LIHEAP) offers financial support to cover utility bills, with many states providing additional complementary programs.

Then there’s the Federal Communications Commission’s (FCC) Lifeline[2] program, for those seeking discounts on telephone or internet bills. With potential savings ranging from $9.25 to $34.25 per month, these programs add some extra relief to a tight budget.

2. Provider Hardship Programs

Your service providers can be valuable allies when you need help paying bills. Many companies offer hardship programs and payment plans designed to make your bills more manageable:

- Due date extensions that grant you a little extra time to catch your breath.

- Discounts that save you money for prompt payment.

- A freeze on bills you owe can give you a temporary break from the bill-paying hustle.

- And in times of dire need, there are even forgiveness programs to forget the money you owe and help you start again.

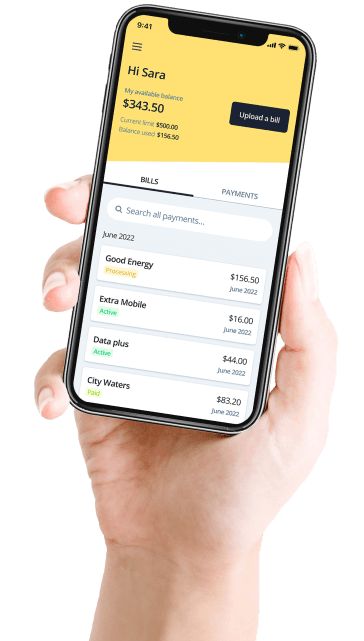

- Payment plans that let you sail through bill payments in smaller installments. And if you don’t want to sit on hold with call centers, check out Deferit. Deferit pays your bills upfront, and you pay back Deferit in 4 installments -from one app.

3. Direct Bill Negotiation

One of the most effective ways to get help paying bills is through direct negotiation. A simple call to your service provider could unlock exclusive discounts, better plans, and significant savings on your monthly bills.

It’s all about putting your foot down and asking for what you deserve. You might be surprised at the perks that await, thanks to those enthusiastic call center champions.

4. Subscription Management Services

With the average person juggling multiple subscriptions[3], managing bills can feel overwhelming. Subscription management services help you reduce monthly expenses by tracking and eliminating unnecessary subscriptions, helping you regain control over your finances.

Whether you’re exploring Rocket Money, Trim and Bobby, a brighter subscription future awaits.

5. Professional Bill Negotiation Services

If direct negotiation isn’t your style, professional bill negotiation services can help. These companies specialize in reducing bills on your behalf, using proven strategies to secure better rates. They typically work on commission, only charging if they successfully reduce your bills.

Ready to explore? Here’s a few providers to check out: BillCutterz, Billshark, Deferit, Experian BillFixer, Trim, Rocket Money.

6. Financial Counseling for Long-Term Solutions

When you need comprehensive help paying bills and managing debt, certified financial counselors provide personalized guidance. Organizations like the National Foundation for Credit Counseling[4] (NFCC) and The Financial Counseling Association of America[5] (FCAA) offer professional support to help you create a sustainable financial plan.

You can also check out The Consumer Financial Protection Bureau[6], a federal agency that helps you make informed financial decisions.

However, keep an eye out for those who wear the title of ‘counselors’ but might just be wearing a different hat behind the scenes. Some advisors might steer you towards restructuring the money you owe, not to help your situation, but to get some kickbacks. Trust your instincts and ask them directly if they get kickbacks or incentives. And of course if in doubt, just use our links above.

Seizing Control: Your Action Plan

Ready to embrace your financial freedom?

Let’s break it down into simple steps. Start by trimming your monthly expenses – think insurance, power, phone, TV, and internet. You’ve got the power to negotiate better deals directly or enlist the aid of bill negotiation services.

And let’s not forget those subscriptions that seem to multiply overnight. A subscription management service is your ticket to decluttering and saving big.

But if the bills still feel like a mountain, don’t hesitate to reach out. Providers and financial counselors are waiting to offer their support, ensuring you’re back on track in no time.

Remember, you’re not alone on this journey. Support is all around you. Embrace the opportunities, ask for help, and take back control of your bills! Get started with Deferit to split your bills into manageable payments today.

References

- U.S. Department of Health and Human Services. “Low Income Home Energy Assistance Program (LIHEAP).” Administration for Children and Families.

- Federal Communications Commission. “Lifeline Program for Low-Income Consumers.” FCC.

- CordCutting.com. “State of Streaming Report.” CordCutting Research.

- National Foundation for Credit Counseling. “Find a Certified Credit Counselor.” NFCC.

- Financial Counseling Association of America. “Professional Financial Counseling Services.” FCAA.

- Consumer Financial Protection Bureau. “Making Informed Financial Decisions.” CFPB.