Vision benefits expire at year-end. Eye exams cost $136 without insurance vs $25 with. Use your coverage before it resets.

Your vision benefits expire in days. That eye exam you’ve been meaning to schedule, the new glasses you need, the contact lens allowance you haven’t touched—all gone on January 1.

And the kicker? You’ve been paying premiums for this coverage all year.

The Price Difference: An eye exam averages $25 with insurance versus $136 without[1]. That’s an $111 difference for an appointment that takes less than an hour.

↑ TopWhat Vision Benefits Expire at Year-End

Here’s what catches people off guard—vision benefits don’t accumulate. You can’t save this year’s exam for next year or bank your glasses allowance. It all vanishes December 31:

| Benefit | What You Get | What Expires |

|---|---|---|

| Eye exam | Usually 100% covered or $10-25 copay | One exam per year |

| Glasses allowance | $150-200 for frames, lenses usually covered | One pair per year |

| Contact lens allowance | $100-200 toward contacts (often instead of glasses) | Annual allowance |

January 1 means reset. No exam this year? Lost. Didn’t use your glasses allowance? Gone. You paid premiums all year—use it or lose it.

Table of Contents

- The Real Cost of Skipping Vision Care

- Eye Exam Costs: Insurance vs. No Insurance

- Glasses and Contacts: Making the Most of Your Allowance

- December Scheduling: Beat the Rush

- When Vision Costs Stack Up

- Next Steps

↑ TopThe Real Cost of Skipping Vision Care

Beyond lost benefits, skipping eye exams has consequences that compound:

- Vision changes go undetected. Your eyesight changes gradually—you might not notice until headaches become constant or you’re squinting at everything. Annual exams catch prescription changes, developing astigmatism, and early presbyopia.

- Serious conditions get missed. Eye exams detect more than vision problems. Doctors can identify early glaucoma, macular degeneration, diabetic retinopathy, cataracts—even high blood pressure and certain cancers. Many have no early symptoms. By the time you notice, damage may be irreversible.

- You pay more later. A prescription update now costs $25 with insurance. A complex issue discovered late costs significantly more in treatment, time, and potentially permanent vision loss.

↑ TopEye Exam Costs: Insurance vs. No Insurance

Here’s why this deadline matters more than you think—the gap between insured and uninsured eye care is one of the starkest in healthcare[1]:

| Location | With Insurance | Without Insurance |

|---|---|---|

| National Average | $25 | $136 |

| Alabama | $22 | $113 |

| Alaska | $31 | $165 |

| California | $31 | $166 |

| Florida | $25 | $136 |

| New York | N/A | ~$150 |

| Texas | N/A | ~$130 |

| District of Columbia | $36 | $174 |

Without insurance, costs range from $105 to $257 depending on the state and type of exam. With insurance, most people pay $20-$49.

↑ TopGlasses and Contacts: Making the Most of Your Allowance

For glasses: Most plans cover frames up to $150-200. Basic single-vision lenses are usually 100% covered, but upgrades add up fast (progressives: $75-150+, anti-reflective: $50-100, photochromic: $75-150). Ask about package deals—many optical shops bundle lens features at a discount.

For contacts: Your allowance is typically $100-200. Compare prices between providers—your allowance might go further at a discount retailer. If your allowance covers a year’s supply, get the full amount now. And don’t forget: contact lens exams and fittings are often covered separately from your regular eye exam.

↑ TopDecember Scheduling: Beat the Rush

Everyone remembers their vision benefits in December. Optical offices are swamped. Call now—the earlier, the better your options. Be flexible and take whatever appointment is available. Try multiple in-network locations. Ask about cancellation lists if nothing’s available. Independent optometrists may have more openings than large chains.

If you can’t get an exam: You may still use some benefits. If your prescription is less than 2 years old, you can order glasses with your existing prescription. Reordering the same contacts with a valid prescription doesn’t require a new exam. And even without an appointment, you can use expiring FSA funds on glasses, contacts, solution, and other eligible items.

↑ TopDon’t Forget FSA and HSA Funds

If you have FSA or HSA funds, vision care is one of the easiest ways to use them before year-end. Eligible expenses include eye exams, prescription glasses and sunglasses, contact lenses and solution, reading glasses (no prescription needed), and contact lens fittings.

FSA deadline alert: Most FSA funds expire December 31 (some employers offer grace periods or carryover). Vision purchases are an excellent way to use expiring funds. For more strategies, see our FSA deadline guide.

↑ TopVision Care Without Insurance

If you don’t have vision insurance, you still have options:

- Warehouse clubs and online retailers – Costco, Sam’s Club, Zenni, Warby Parker, and EyeBuyDirect offer eye exams and glasses at significant discounts.

- Retail optical centers – Walmart Vision, Target Optical, and America’s Best have lower prices than private practices.

- Optometry schools – Teaching clinics offer comprehensive exams at reduced rates, supervised by instructors.

- Vision discount plans – Programs like EyeMed Access or VSP Individual offer discounted rates without being full insurance.

↑ TopWhen Vision Costs Stack Up

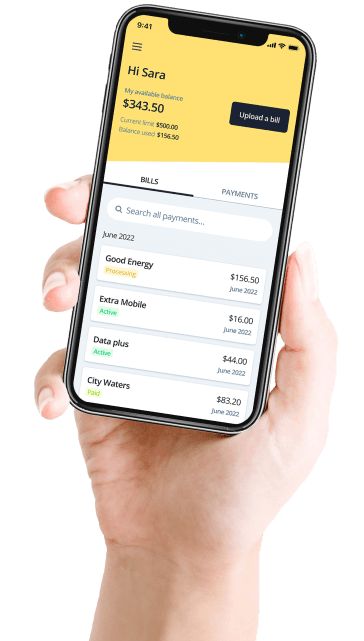

Year-end can pile up vision expenses: exam copays, glasses out-of-pocket costs, contact lens purchases, plus regular holiday spending. If using your vision benefits means stretching your budget, remember you don’t have to pay for everything at once.

Deferit lets you split bills into 4 payments over 8 weeks, which is helpful when you’re maximizing multiple benefits before December 31.

↑ TopNext Steps

Your vision benefits expire December 31. Call your eye doctor today.

If no appointments are available, get on the cancellation list. At minimum, order new glasses or contacts with your existing prescription before year-end.

For comprehensive year-end healthcare planning, see our end of year medical bills guide.