If you want to find out where your money is going each month, the first place to start is a budget. Our blog shares tips and tricks for a solid financial plan.

It can be argued that the first step on anyone’s journey toward financial freedom is creating a budget. A budget is a clear overview of where your money is going every month and provides insight into your spending habits. An effective budget can also help you stay on track and meet your financial goals.

While making a budget sounds like a simple task, if you’re not honest with yourself about your spending and saving habits, it’s easy for it to get pushed aside. According to a 2020 survey by Mint[1], 65% of Americans have no idea how much they spent in the previous month. And this might not be all that surprising, given the rise of contactless payments and the convenience of going cashless.

The good news is, devising an effective budget doesn’t have to be a chore or force you to give up the things you love. We think that with the right method in place, you’ll become a budgeting pro in no time. In this blog, we’ll share steps on how to create the perfect budget, answer some commonly asked questions about budgeting and share some simple ways to reduce your expenses.

How to budget money

Before you can start putting together a budget, you’ll need to get your numbers straight. We’re talking your income, monthly expenses, savings goals or other financial priorities, such as debt. Having all these at the ready can make the process smoother, as you won’t be left estimating figures.

Calculate your income

If you’ve decided to organize your budget on a monthly basis, you’ll need to divide your take income by 12 to get your monthly salary. This number is what you’ll be working with and dividing into different spending categories. It’s also important to add any income you make through side hustles, as this will give you a more accurate picture of your cash flow.

Figure out your expenses

Now that you’ve got your total income for the month, the next step is to start listing your expenses. While there might already be obvious ones that jump to mind, such as your groceries, rent or mortgage payments, it’s still a good idea to get as accurate as you can. Pull up your most recent bank statement, grab a highlighter and sift through a month’s worth of transactions, tracking your essential expenses as you go. Outside rent or groceries, your essential expenses includes things like:

- Utilities

- Insurances

- Daycare or school fees

- Medical costs

- Debt repayments, such as a credit card or personal loan

You’ll also need to mark out your non-essential expenses, also known as:

- Gym memberships

- Streaming service subscriptions

- Clothing, shoes, etc

- Hair or beauty products

- Takeout or nights out

Noting your expenses in this way is a fantastic way to see exactly how much you spend every month, especially in an age where payments have all but gone cashless and contactless. You might even come to find the amount you’re spending is more than you anticipated. We’ll talk about how you might want to reduce these expenses later.

List your priorities

Once you determine how much of your monthly salary goes toward essential and non-essential expenses, the final step is to calculate the amount you’ll be contributing to your financial goals. Some common examples of financial goals include setting up an emergency fund, preparing for retirement or paying off personal debt.

The amount you decide to put toward these goals will depend on factors, like your salary, the financial size of your goal and the timeframe in which you’d like to achieve these financial goals. It’s important to find the balance between having enough money set aside to keep up with your lifestyle and making effective contributions to your goals.

While this might take you some time to get right, having a definitive plan on how your money will spread throughout the month will keep you on track and help you avoid dipping into your savings stash.

Try 50-30-20 budget rule

When you’re new to living on a budget and managing your money, the goal is to keep things simple and realistic. So if you’re finding it difficult to split your money between the different categories, you might want to try the 50-30-20 rule popularized by Senator Elizabeth Warren[2]. This is where 50% of your after tax income goes to your necessities, 30% is dedicated to your ‘fun money’ and 20% is put toward your saving goals or debt repayments.

Aside from its simplicity and sustainability, the 50-30-20 rule is a great starting point to managing your money. As you start to follow this method, you’ll feel more confident to adjust your money split to better suit your needs.

Reduce your expenses

When sifting through your monthly expenses, you might find there are opportunities to make space in your budget simply by cutting back in certain areas or getting smarter with the way you spend. Some of the most common costs that are easy to cut back on are food, entertainment and even the way you pay your bills!

Subscriptions

From Disney Plus to Netflix, there are a range of streaming services available that keep us entertained. While costs for these services range between $10 - $14 per month, having more than one active account can add up!

For instance, at the time of writing, a Disney Plus subscription will set you back $9 a month or $108 a year, meanwhile, a basic Netflix account is the same price at $9 a month or $108 annually. Having both subscriptions running at the same time totals to $216 a year!

Do your wallet a favor by only limiting yourself to one streaming subscription.

Get into meal prepping

Traditionally, meal prepping was reserved for those who like to keep up a healthy diet by planning out their meals in advance. But the good news is, it’s also a great way to save money and time on grocery costs. There are many financial benefits to meal prepping, like not having to buy an assortment of ingredients and instead only picking up the things you need and will actually use.

According to recent data[3], the average American spends $67 a week on food delivery services equating to a massive $3,484 a year! Having your meals planned out will also keep you from giving into convenience and using these services.

Before the start of a week, write out a meal plan and ingredients for your breakfast, lunch and dinner, plus snacks. You can find a variety of meal-prep friendly meals online which are not only tasty, but cost-effective.

Shop with a list (and stick to it!)

But if you prefer to have a good mix of meals throughout the week, there are other ways to save on your weekly grocery shop. One of the biggest money wasters when it comes to grocery shopping is impulsively adding random items to your shopping trolley.

This often happens when supermarkets have discounts or introduce new items. Although this may only be a few extra dollars here and there, if you shop this way consistently, you could be costing yourself hundreds of dollars in unnecessary groceries.

To keep yourself from going overboard, write a list of items you need before heading out to the supermarket and stick to it.

Ditch late fees for good

According to NerdWallet’s 2018 Consumer Credit Card Report[4], 35% of Americans missed a payment simply because they forgot about it. For a lot of us, bills have a tendency to sneak up on us. But with late fees ranging between $25 to as much as $50, it’s time to put an end to them once and for all.

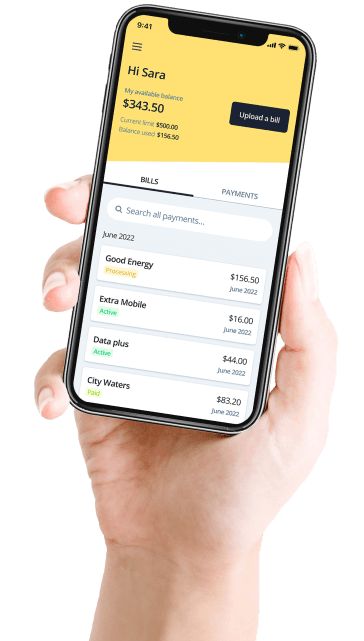

Of course, the easiest way to avoid late fees is to pay every bill on time, but with every bill having a different due date, things can get tricky. Luckily, there are many tools and resources available that can help you keep track of your bills, like Deferit.

Deferit is an app that helps you take care of any bill by splitting them into 4 smaller payments, making them easier to manage. Meanwhile, Deferit pays your bill upfront and on time. The platform also is highly budget-friendly, charging zero interest so you never have to worry about being out of pocket on a bill ever again. Get started with Deferit to simplify your bill payments today.

Budgeting FAQs

As you’ve probably realized by now, creating a proper budget takes time and effort. But because no person’s financial circumstances are ever the same, there may still be a few unanswered questions, like what to do if you’re spending more than earning or if you have a varying stream of income.

What should I do if my expenses exceed my income?

Whether it’s impulsive overspending or rising living expenses, it’s not uncommon for a person’s monthly expenses to exceed their income. This may force you to either dip into your savings or rely on credit to keep with your essential costs.

Aside from being a quick fix, regularly relying on credit can damage your credit score and cost you a small fortune in interest or drain your savings account.

Living paycheck to paycheck is never ideal and can stop you from creating future wealth for yourself. In this case, it might be worth looking into dramatically reducing your non-essential spending or getting savvier with your essential costs.

Depending on your situation, this might mean setting yourself up on a no-spend challenge, shopping around for a more competitive home loan or energy deal.

What if I don’t get paid every month?

Whether you’re a part time employee or work for yourself, fluctuating incomes or varying pay cycles are not uncommon. In cases like these, following a traditional monthly budget might not be a suitable option.

If you’re someone with a different pay cycle, for instance, you get paid weekly or fortnightly, you’ll simply need to create a budget based on a weekly or fortnightly basis. Having a structured budget when you have a shorter pay cycle will help you stretch your money further and keep you from living paycheck to paycheck.

On the other hand, if your income changes every time, your approach will need to be slightly different. While you’ll have to jot down your essential and non-essential expenses and financial goals, you’ll also need to calculate an average income amount by looking back at your last few paychecks. This is so you have a figure to work with when setting up your budget.

As time goes on and your income starts to increase or decrease, you may need to make adjustments to your budget.

References

- CNBC Select. “Why Budgets Don’t Work for 80% of People - 2020 Mint Survey.” CNBC. 2020.

- Bankrate. “What Is the 50-30-20 Rule? How Senator Elizabeth Warren’s Budgeting Method Works.” Bankrate.

- Motus. “Motus Report Reveals Food Delivery Services Surged 164% Over the Last Year, with 25% More Americans Using Food Delivery Apps.” Business Wire. March 2021.

- NerdWallet. “2018 Consumer Credit Card Report: Don’t Make This Common and Costly Credit Card Mistake.” Via WCNC. 2018.