Expert guide to paying off credit card debt with proven strategies including repayment plans, balance transfers, and debt consolidation options.

Learning how to pay off credit card debt is essential for achieving financial freedom. Credit card debt affects millions of Americans, with the average household carrying over $6,000 in credit card balances according to the Federal Reserve[1].

Left unmanaged, credit card debt can prevent you from reaching important financial goals like buying a home, and late payments can significantly damage your credit score.

This comprehensive guide will show you proven strategies to pay off credit card debt faster, including creating effective repayment plans, utilizing balance transfer cards, and accessing professional financial help when needed.

1. Create a repayment plan

Learning how to pay off credit card debt begins with creating a strategic repayment plan. Your credit card debt repayment plan should include the timeframe for becoming debt-free and the monthly amount you can realistically contribute. The most effective way to pay off credit card debt faster is to review your monthly budget thoroughly, identifying areas to reduce spending so you can allocate more toward paying off credit card debt each month.

The first step to paying off any kind of debt is to formulate a repayment plan. Your repayment plan should have the time in which you intend to pay off your debt and the amount you want to contribute each month.

The best way to determine both is to take a look at your monthly budget.

While it’s important to first consider areas where you can reduce your spending, it might also be worth reconsidering your savings goals. That’s not to say you abandon them completely, but rather reduce the amount you contribute, so you can put more towards your debt.

Shifting this mindset could also benefit you and help you clear your debt faster. The trick to doing this is setting a realistic timeframe so you’re not having to ditch other financial goals completely.

One thing to keep in mind is that debt looks different for everyone, and it’s not uncommon for many Americans to have multiple types of debt, which can make your debt-free journey all the more difficult.

In this case, you might need to consider extra help to work with your repayment plan, like a debt consolidation loan.

Debt consolidation involves rolling multiple debts into one payment. This way, you’ll only have to focus on one monthly repayment and interest rate, which can help you save over the long run.

It also means that your debt repayments won’t eat into your monthly budget. If you’d like more information about how debt consolidation works, check out our Debt Management Guide.

2. Be active with your repayments

Once you’ve got your repayment plan down, your next step is to stay consistent. This not only means paying on time, but making more than the minimum repayment.

While paying on time keeps you from being stung with a late fee, making more than the minimum repayment every month will save you a bundle in interest.

To give you an example of what that looks like, let’s say you have a $2,500 credit card balance, with an interest rate of 18%.

According to credit card payoff calculators[2], if you were to only make the minimum repayments, it could take over 20 years to clear the balance and you’d pay thousands more in interest.

On the other hand, if you were to pay $123 every month, it would only take two years to pay off and you’d spend significantly less. That’s a difference of thousands of dollars in interest!

3. Find ways to funnel extra cash to your debt

If you’ve decided to make paying off debt your top priority, then you’re going to have to get creative to get to the finish line faster.

An easy way to find some extra cash to put toward your debt is to sell items online, like equipment or appliances you no longer use, old clothes or shoes and furniture. Platforms like Facebook Marketplace or Poshmark make this super easy to do and introduce you to a wide range of buyers.

It might also be worth revisiting your budget to find areas where you can reduce your spending or picking up a side hustle where any money you make is fed directly to your credit card debt.

4. Consider a balance transfer credit card

While you might be on top of making your monthly repayments, your card’s interest rate might continue to be a roadblock to getting debt free.

One way to pay your debt off faster and reduce your interest payments is to pick up a balance transfer credit card. These are credit cards that feature a 0% interest rate for a set period of time, with promotional periods typically ranging from 12 to 21 months[3].

The way it works is that once you are approved for a balance transfer card, the new card provider will transfer the balance onto your new card and pay the debt to your previous provider.

You are then free to pay off your debt without attracting any interest. While a balance transfer card can help you save big on interest, it’s worth noting that once the balance transfer period is up, the card’s rate will then revert to a higher interest rate (typically the cash advance rate), so be sure to choose a card with an appropriate balance transfer period to ensure the debt is cleared before this happens.

5. Seek alternative help

Between paying other bills and keeping up with regular expenses, your debt may begin to become overwhelming and impossible to get on top of.

If this sounds like your situation, there are options available that can help. For example, The Financial Counseling Association of America (FCAA) is a not-for-profit organization that helps people with their debt. The anonymous service assesses your financial situation and then provides free financial advice on what you can do.

Depending on your circumstances, your financial counselor may help you get in contact with your credit provider to negotiate a payment plan. In some cases, creditors may waive certain fees and interest charges to help you get back on your feet.

What to do once your credit card debt is cleared

Clearing your credit card balance and getting debt-free is a massive achievement and should be celebrated! However, it doesn’t mean that the job is done. Because of the ease and accessibility of credit cards, it’s quite easy to fall back into old habits.

It’s important to equip yourself with the knowledge and skills to make sure debt doesn’t creep up on you again.

Give yourself a fresh start financially by checking out our top four tips below:

Close your credit account

If you think you might not be able to manage your credit card responsibly, it might be time to say goodbye to your plastic for good. Once your balance is cleared, cut up the card and close the account. By removing the temptation altogether, you’ll slowly learn how to better manage your spending without having to rely on a credit card.

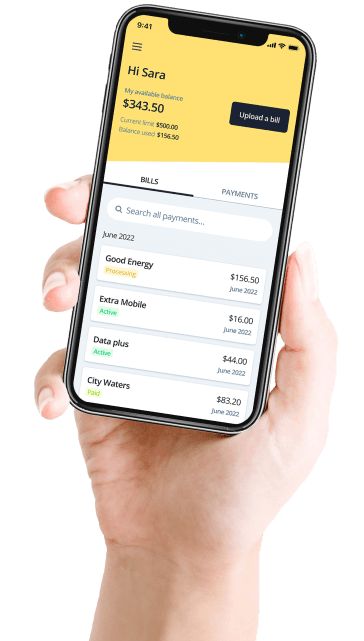

Of course, this might also mean having to make some adjustments to the way you manage certain expenses. For example, if you used your plastic to pay big bills, you might want to explore alternative options, like Deferit.

Deferit can take the bite out of big bills by splitting them into 4 smaller payments, making them easier to stay on top of. And unlike your credit card, Deferit is totally interest-free, offering its users the flexibility they need for big bills.

Switch to a better deal

On the other hand, if you’re not ready to say goodbye to your credit card just yet and are prepared to use it responsibly, you could consider switching to a better deal, like a low rate credit card. As the name suggests, these are credit cards that feature an interest rate below 15%.

If you’re a spender who tends to carry a balance, lowering your card’s rate will help you avoid paying a small fortune in interest each month.

Depending on the product, these cards come with no ongoing or annual fees, which can also help you save annually. Just keep in mind that low rate cards tend to be a no-frills product. This means they might not offer special features, like a rewards program or complimentary travel insurance.

Have a new plan for emergencies

For many households, a credit card is for emergencies only. And while this might work for some, if you have a tendency to go overboard with your plastic, this might not be an appropriate choice for you.

Rather than relying on your credit card to get yourself out of sticky situations, an emergency fund will take care of the problem without throwing you into debt.

Unlike your regular savings account, an emergency fund is a separate savings account that is only used when a person comes into unforeseen circumstances. This could be anything from having to purchase a new fridge to an urgent medical bill.

There’s no right or wrong way to build your emergency fund, as your saving goal will depend on your situation, though financial experts often recommend having enough to cover three months of expenses[4].

And the good news is, even if you are hit with an unexpected bill and your emergency fund isn’t up to scratch just yet, you don’t have to resort back to your plastic.

Deferit takes care of bill shock by splitting them into 4 bite-sized payments. The platform gives you the breathing room to get on top of your bills, without charging any interest.

You can also reschedule payment dates to better suit your lifestyle, a feature not available with the common credit card.

Work on your overall financial health

Once you’ve done the work to get yourself out of debt, the final step is to implement some new money habits. We recommend starting fresh with a new budget to gain a clear picture of where your cash goes each month. From there, you might want to reduce your spending across certain areas or make saving more of a priority.

Another way to improve your financial health is to pick up some new tools that help simplify your finances. For instance, Deferit is a bill budgeting app that allows you to split your bills into instalments.

Simply upload a photo of your bill and Deferit will pay it upfront. You then enjoy the flexibility of paying it back over 4 smaller installments.

Deferit charges zero interest, so you won’t have to worry about missing a payment or being stung with super high fees like you would with a credit card.

Want to learn more about Deferit? Find out how it works or get started today. And if you’d like more tips and tricks on money management, check out the Deferit blog!

References

- Federal Reserve Board. “Changes in U.S. Family Finances from 2016 to 2019: Evidence from the Survey of Consumer Finances.” Federal Reserve Bulletin. September 2020.

- Calculator.net. “Credit Card Payment Calculator.” Calculator.net.

- CreditCards.com. “2021 Balance Transfer Survey: Balance Transfer Offers Waning.” Barri Segal. March 2021.

- Federal Reserve Board. “Economic Well-Being of U.S. Households in 2020 - Dealing with Unexpected Expenses.” Survey of Household Economics and Decisionmaking. May 2021.