So you've decided to take the plunge and start your journey to home ownership. The first step? Saving for your home down payment.

For a lot of us, there’s no better feeling than owning your home. But before you can start homeownership bliss, you’re going to need a down payment. Your down payment is the first contribution you make toward owning your home.

According to the Federal Reserve of St. Louis, as of the second quarter in 2021, the average property price in America now sits at $374,900, a 16.2% or $50,000 increase from 2020 to 2021.

Between fees and interest rates, there’s a lot to consider when buying your first house. In this blog, we’ll outline all the ins and outs of making the first step towards property ownership, provide tips on how you can save for your down payment faster and get your mortgage approved.

How much do I need to save for a mortgage down payment?

The amount you need to save for a down payment on a house will depend on the value of your property. A general rule of thumb is to have at least 20% of the property’s value saved up before you approach the bank for a loan. For example, if the property you’re looking to purchase is $350,000, you’ll need a deposit of $70,000. However, it is possible to be approved for a mortgage with a down payment of less than 20%. In fact, at the time of writing, the average down payment on a house was 12% of the property’s value.

Another thing to consider when calculating your home down payment amount is the loan-to-value (LTV) ratio. Your LTV is the mortgage amount divided by the property’s purchase price. Using our previous example, if you purchase a $350,000 property and you have a $280,000 loan, your LVT would be 80%.

Calculating your down payment amount can be difficult, as property prices fluctuate depending on the market. To give yourself the most accurate goal, try to save the average amount properties within your price range sell for.

Can I buy a home with less than a 20% down payment?

Yes, you are able to purchase a property with a down payment of less than 20%, with the minimum down payment for a mortgage sitting at 5%. According to figures from personal financial site, Mint, it takes the average American household 4.25 years to save a 20% down payment, so it’s not surprising that many buyers look to purchase property with smaller down payments. However, there are a few things to be aware of.

Purchasing a property with a down payment smaller than 20% means having to pay higher interest rates. This is because lenders often see borrowers with smaller down payments as higher liabilities, so the higher rates are to safeguard themselves. A smaller down payment also means Primary Mortgage Insurance (PMI). PMI is a type of insurance a lender charges a buyer to ensure they aren’t out of pocket if you default on your mortgage. The amount you’re charged is typically between 0.5% to 1% of the annual mortgage cost and is added to your monthly repayment. PMI is often waived once a borrower pays down enough of the mortgage’s principal.

How can I avoid paying Primary Mortgage Insurance?

It is possible for a buyer with a smaller down payment to avoid PMI and get access to better interest rates by a tactic called piggybacking. This is a process where a buyer takes out an additional mortgage, which is secured with the property. An example of a piggyback mortgage is called a second mortgage, a home equity loan or a home equity line of credit (HELOC). A piggyback mortgage is commonly used to help pay for the property’s down payment and to avoid PMI, as it helps lower your LTV.

Let’s say you’ve decided to use the piggyback method when purchasing a home. You’ll have your mortgage to help cover the cost of the property, but at the same time, a second mortgage or equity loan will be taken out, giving you an 80-10-10 piggyback mortgage. In this example, 80% of the property’s price is covered by your first mortgage, 10% is covered by the second loan and the remaining 10% is your down payment. Using the previous example, if you’re purchasing a home worth $350,000, your first mortgage would be $280,000, the second would be $35,000 and your down payment would total $35,000.

How to save money for a house down payment

With the average first home buyer needing just over four years to save for a down payment, getting smarter with how you use your cash is essential. Whether you’re currently on or about to start your savings journey, we’ve got four tips on how to save money for that down payment.

Open a down payment savings account

Since you’ll most likely be saving for your down payment for a while, it might make sense to keep the money in a designated savings account. Doing this will give you a clear picture of where you’re at with your savings goal, compared to if you were keeping the funds in your regular savings account. Keeping the money in a separate account will also remove the temptation to dip into your savings.

Just make sure you’re sticking your savings into a high interest savings account, so you can hit your goal all the more faster.

Reduce your spending wherever possible

With down payments on houses hitting the six figure mark, it’s important to start cutting costs wherever possible to get you to that amount faster. Review your monthly budget to determine if there are areas where you can reduce your spending or cut them out altogether. Depending on your lifestyle, this might mean cutting down on online shopping, ditching that gym membership you no longer use or setting a limit on the number of times you eat out in a month.

Pick up a side hustle for extra income

One way to get to your house down payment goal quicker is to pick up a side hustle for extra income. This could include things like freelancing if you have a specific skill, such as video editing, writing or photography or even renting out your car on rideshare services. Another way to pick up some extra cash is to sell items you no longer need or use. Platforms, like Facebook Marketplace or Poshmark, make this easy to do and can give you access to a wider range of people.

Opt to purchase second hand

Between saving for your house down payment and purchasing your first home, there are going to be some unavoidable expenses along the way. This might be having to purchase new furniture or a new outfit for an important event. If you are determined to save and scrimp, try going second hand wherever you can. This might mean joining Facebook groups or browsing second-hand retailers to source the items you need. Or if you’re looking to cut costs further, try asking family or friends if they can lend you the things you need that they no longer use.

While there are some items that can’t be purchased second hand, making the effort to find cheaper alternatives will allow you to contribute more cash toward your house down payment.

Tips for getting your mortgage approved

In order to get approved, first home buyers these days need to do more than just come up with a hefty down payment. To better your chances at getting approved, have a read of our four quick tips for homeownership bliss.

Have proof of genuine savings

When determining whether you’re capable of making repayments each month, a lender evaluates your entire financial situation, including your ability to save. It’s important to show a potential lender you can be responsible with money and regularly save, as they may ask to look at recent bank statements. In this case, try to have at least proof of frequent contributions to your savings account for around three months.

Ditch debt

If there’s one thing that raises eyebrows when it comes to lending, it’s debt. Personal debt, like credit cards and personal loans, are a big red flag to lenders, as they are recognized as liabilities on your application. Depending on the size of your debt, a lender might believe this will impact your ability to make repayments to your mortgage. Before you get ready to submit your mortgage application, make sure to get on top of your debt first.

Do your mortgage research

While it might be easier to apply for the first mortgage you see, not taking the time to research different products could see you miss out on a better deal or getting approved. In order to choose the right mortgage, you’ll need to have a solid understanding of what you can afford to borrow. Once you find the option that best suits your financial circumstance, you can feel more confident that your application will be approved.

Pay every bill on time

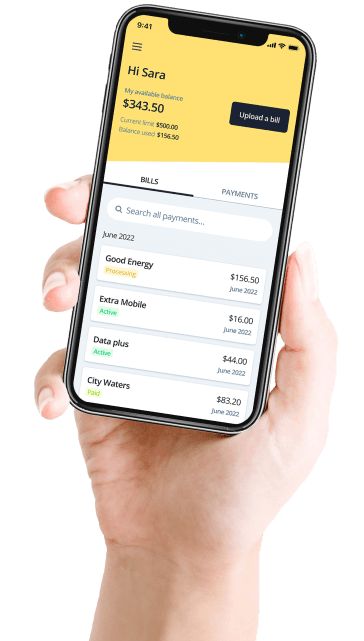

Another way to show your lender you’re fantastic with managing your money is to pay your bills on time. When you’re in the approval process, potential lenders will dig into your credit history to find any marks on your file, like unpaid or late payments on unpaid bills. One easy way to guarantee every bill is paid on time is to sign up to Deferit, the budgeting app that pays your bills.

Deferit pays your bills upfront and in full, meanwhile, you enjoy the flexibility of paying it back over 4 installments every two weeks. The platform not only makes bills easier to manage but you’ll be given complete control over your payment dates. You can reschedule payment dates for free and get a balance of up to $2,000 to pay bills, which allows you to track and manage multiple bills in one convenient location.

Mortgage pre-approval: What do I need to know?

Mortgage pre-approval is a process where a lender provides an estimate of your borrowing capacity, if you meet certain criteria. These conditions might include getting debt-free or supplying specific documentation, like the property’s value.

Having pre-approval gives you the confidence to attend open houses knowing how much you can afford to spend, meaning you won’t waste time on properties outside your price range. Sellers will also take you more seriously when you make offers, as you’ve already locked in an agreement with a lender.

The first step to getting pre-approved is to compare and choose a lender based on what best suits your needs. Once you’re happy with your pick, get your finances in top shape and submit a pre-approval application. During this time, the lender will assess things like your credit score, your income, expenses and any debts you have. If the lender deems you eligible for the loan, they will grant you pre-approval.

Just keep in mind that not all lenders give pre-approval, so be sure to double check the details before applying.

Ready to start saving for that down payment? Give yourself one less thing to worry about by uploading your bills to Deferit! Head on over to our home page to create your account, or if you’d like to learn more about money management, check out the rest of our blog.