They say once you become a parent, your money is no longer about you. In this blog, we share tips on how families can save big on everyday spending.

Finding effective money saving tips for families is essential for achieving financial stability while providing for your children. From school pickups to household management, raising a family is challenging - and when you add financial management to the mix, things get even more complicated.

Financial pressure affects many families, with a Capital One CreditWise survey[1] showing 73% of Americans rank finances as their top stressor. If money worries are impacting your wellbeing, learn strategies to manage financial stress alongside implementing these saving tips.

Figures from the 2015 USDA Consumer Expenditures analysis[2] show that the average middle-income household spends $12,980 annually per child, and with rising costs, this number has only climbed higher.

With this kind of added expense, how can you make sure you still hit your personal financial goals and keep up with everyday costs? In this guide, we’ll share proven money saving tips for families with simple hacks and tricks to help you cut costs.

Purchasing Generic or Home Brand Products

When you’re heading to the shops, set yourself a challenge to pick up generic or home brand products, instead of buying your favorite branded items. While it can be tempting to indulge in name brand products, they tend to come with a premium you don’t need to be paying.

Quite often, generic products are actually made from the same materials or ingredients as their name brand counterparts, they just don’t have their brand reputation.

The good news about purchasing generic brand products is that they range from bread to canned goods and even cleaning products, so there are opportunities to save everywhere. So the next time you go shopping for groceries, medicine or homewares, try and buy the generic brand to save yourself some money!

For more strategies on cutting spending on everyday purchases, check out our comprehensive money-saving guide.

Using Coupons on your Purchases

Coupons are a great way to help you snag a discount on your next purchase and can be found in a variety of places.

If you’re making a purchase online, check out some applications that can provide you with coupons others have been using.

If you’re shopping in person, there are some ways of sourcing coupons that you can use in-store. Try joining the loyalty programs offered by the stores you’re a regular customer of, as many companies offer discounts to their members.

Buy Toys & Gifts During Sales

Gifts are something that you’ll not only be purchasing for your kids on special occasions, but also for their friends for birthday parties. But gifts can be expensive, especially if your child has a few pals!

To help you save, try to stock up on presents when stores are holding sales, like mid-season sales or even Black Friday, as you could benefit from amazing discounts.

It might also be worth jumping online to see if you can find the toys cheaper elsewhere and asking stores if they’d be willing to price match.

Choose Streaming Services over Cable

The days of cable television being the most popular way of streaming your favorite shows are long gone and for a good reason. Streaming services provide a much cheaper, and more flexible way for you and the kids to catch all the shows and movies you love.

At the time of writing, you can access Disney Plus for $7.99 a month[3] or Netflix’s Basic plan for $9.99 a month[4]. Many young people prefer streaming services for the original and exclusive content they provide. And because you can stream these shows and movies on just about any device, your kids can enjoy their favorite movies no matter where they are at home.

Reduce Your Utility Bills

Beyond entertainment costs, utility bills often represent one of the largest household expenses after rent or mortgage.

Many families overlook simple ways to save on their electric bill through energy-efficient habits and smart device usage.

According to the U.S. Department of Energy[5], simple changes like adjusting your thermostat, using LED bulbs, and unplugging devices can reduce electricity costs by 10-20% annually - that’s hundreds of dollars back in your family budget.

Make a Budget

Between paying your mortgage to refreshing your child’s wardrobe, knowing exactly where your money is going every month can feel impossible.

A sure-fire way to get a better understanding of your household’s spending is to make a budget. You can do this by sorting through your most recent bank statements to calculate how much you spend across certain categories.

This can help you find areas where you can reduce costs and reign in your spending. You can learn more about how to create a budget and save money with our step-by-step guide that includes the 50-30-20 budget rule.

Avoid High-Interest Debt

While implementing these money-saving strategies, it’s crucial to avoid accumulating credit card debt to cover family expenses.

According to the Federal Reserve Survey of Consumer Finances[6], the average American household with credit card debt carries over $6,000 in balances with interest rates averaging 15%.

If your family is struggling with credit card balances, learn how to pay off credit card debt faster with proven strategies including the debt snowball method and balance transfer options.

Experiment with Meal Prepping

No matter the size of your family, anyone can benefit financially and mentally from meal prepping. Not only is this a great way to save time for busy families, but it could also help you save on your grocery bill.

Before you head to the supermarket to pick up your essentials for the week, spend some time creating a menu for the week, including breakfast, lunch, dinner and snacks for in between meals.

One way to cut costs further is to select a menu that uses the same ingredients, rather than trying to create an entirely different meal every time. Getting creative with canned goods or cheaper ingredients, like rice and pasta is also another way to save on food.

Once you’ve got your menu lined up, write down the ingredients you’ll need to make everything, which will now become your grocery list. This way, when you head into the supermarket, you won’t mindlessly add things to your cart and only purchase the items you need.

Avoiding Late Fees on your Bills

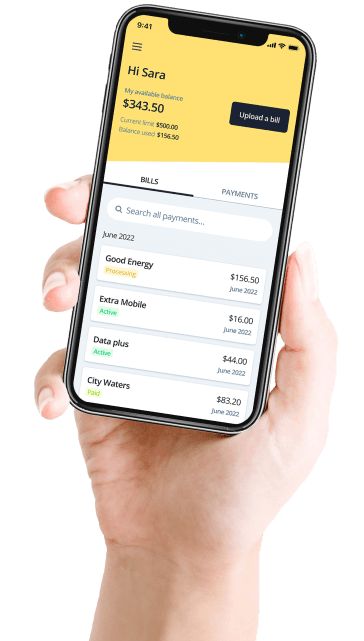

As a parent, you’ll often be left to juggle multiple tasks, which can make getting bills paid on time all the more difficult. And unfortunately, overdue bills can make you subject to fees, which can add to your financial stress. However, with the help of Deferit, this doesn’t have to be the case.

Deferit is an online bill payment platform that can take the stress out of paying upcoming bills.

Get started with Deferit by snapping a photo of a bill you want paid and uploading it to our site. We’ll pay your bill on time and in full, meanwhile, you pay the amount back in 4 interest-free installments.

Start with one or two strategies that fit your family’s lifestyle, then gradually incorporate more as they become habits. Small, consistent changes in spending can free up hundreds of dollars monthly - money that can go toward your family’s financial goals and future security.

References

- Capital One. “Survey Reveals Tension Between Financial Stress and Optimistic Financial Outlook Among U.S. Consumers - CreditWise® from Capital One® Survey.” PR Newswire. October 2019.

- U.S. Department of Agriculture. “Expenditures on Children by Families, 2015.” Mark Lino and Kevin Kuczynski. Center for Nutrition Policy and Promotion. March 2017.

- Disney Plus. “Disney Plus Pricing and Plans.” Wayback Machine archive. January 2022.

- Netflix. “Netflix Plans and Pricing.” Wayback Machine archive. January 2022.

- U.S. Department of Energy. “Energy Saver: Tips on Saving Money and Energy at Home.” Energy.gov.

- Federal Reserve Board. “Changes in U.S. Family Finances from 2016 to 2019: Evidence from the Survey of Consumer Finances.” Federal Reserve Bulletin. September 2020.