Split any bill in 4 today

Always interest free, no late fees

No impact to your credit score

Never pay a late or overdraft fee again

Enjoy flexible payment dates

You're in great company!

But don't take our word for it, see what other people are saying!

Frequently asked questions

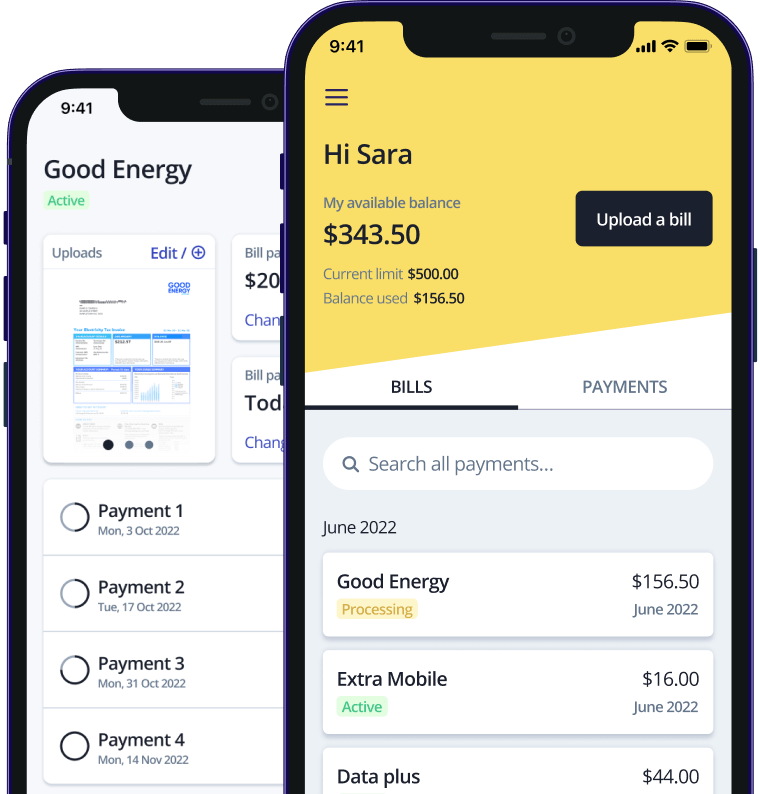

Deferit is an interest-free bill payment and budgeting tool. With the Pay in 4 feature we pay your bill upfront and you pay it back in 4 flexible installments. Simply upload your bill and we’ll take care of the rest. If you don’t want to split your bill into installments but want to pay bills by card in one convenient location, our Pay in 1 feature allows you to simply take a photo of the bill you want to pay, pay the amount via Deferit and we pay the bill for you. We’ll even mail a check for you if your biller requires it!

There’s a simple $14.99 membership fee you can cancel at any time. The first month cost is $29.98 including an application fee. When uploading your bill, you specify the date for us to pay your bill and the amount you would like us to pay on that date. Your 4 payments begin on this date and we take the first installment whilst paying your bill upfront and in full.

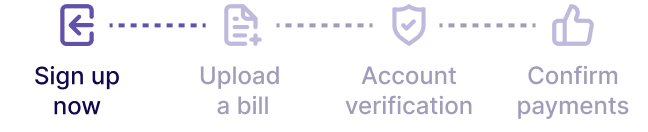

Paying a bill has never been easier! Simply click the “Upload a bill” button when logged in to our website or mobile app, snap a pic of your bill or upload from your library/files. Specify the amount and date to pay your biller and that’s it!

That’s right. We don’t charge interest and we don’t believe in late fees! How do we keep the lights on? There’s a $14.99 simple membership fee for up to $2,000 of balance to pay bills. First month cost is $29.98 incl. the application fee. Payments incur a 99c processing fee.

Signing up for Deferit does not impact your credit score. When you pay for a membership, we perform a quick soft inquiry to verify your identity, which does not leave any marks on your credit file. However, your usage and payment history with us may affect your credit over time. Consistently making on-time payments can positively impact your credit score, as we report your payment history to the credit bureaus. Late payments can negatively affect your credit score.