Newsroom

Download our media kit and get in touch with us. For further enquiries on any of these topics, please contact media@deferit.com.

Myths busted

This section debunks some common misconceptions about Deferit. We ask that you read the below facts to ensure consumers are presented with accurate information. For further enquiries on any of these topics, please contact media@deferit.com.

Deferit assesses all customer bills. When we see any indicator that a customer is in hardship, we deny the bill deferral and refer them to get in contact with their bill provider to seek assistance. We encourage customers to interact with their bill providers, even when they may not be aware such an avenue exists. We advocate hardship solutions offered by billers and have a strict responsible budgeting code of conduct.

Traditional finance solutions (such as credit cards and personal loans) can obfuscate hardship from billers with the debt able to revolve while outstanding balances accrue interest.

Billers have full visibility over their accounts just like they do with any other payment method.

If a customer is behind on a payment they are unable to defer further bills. The account is paused as soon as any of their installment payments are missed, preventing people from “kicking the can down the road”.

Deferit promotes responsible payment behavior. In practice, 54% of Deferit users that join with an overdue bill will pay their next bill on time, evidence that Deferit is helping people get ahead of payments and practice financial responsibility.

This service is not offered by all billers. Car registrations, childcare and healthcare generally don’t offer payment plans and these are some of the most popular types of bills uploaded to the platform. While there are billers that do offer payment plans, Deferit provides an easier, faster and more empowering alternative.

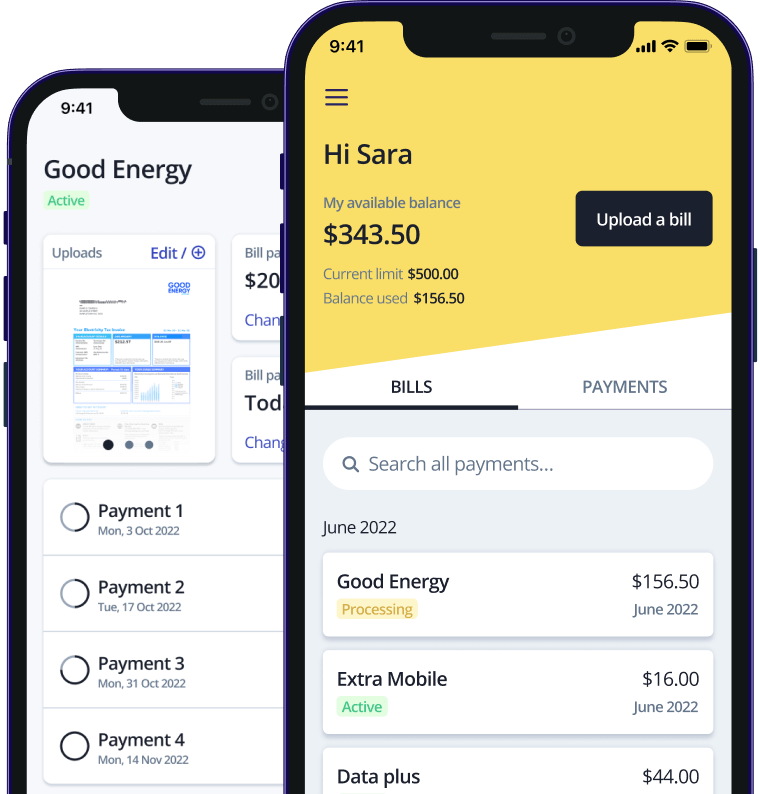

Deferit is a self-service platform that allows customers to have total control over their bills. Instead of waiting in call centre queues to discuss their late bill or to negotiate a payment plan, customers can manage their bills within the app. It’s empowering for customers to simply upload their bills, knowing they can easily reschedule payment dates and pay bills earlier via our app. In our customers’ own words, ‘Deferit is life changing’.

Bill smoothing in electricity requires the customer to make forward payments against an estimate of usage - which often leads to a ’true up’ payment at a later point in time. Using Deferit allows people to pay their bill based on its actual usage and know the full final cost up front. We’ve heard from customers who have used smoothing solutions that they’ve had a negative experience when the ’true up’ occurs, often resulting in them needing to pay an unexpected difference that they haven’t budgeted for.

What’s more, customers on these programs still aren’t able to easily move payments in a given month if a life event happens and are left without a solution to smooth those payments between their pay cycles at times when they need it most.

Deferit doesn’t create debt for the consumer - we only deal with bills that are non-discretionary in nature. The customer owes their biller the funds with or without us. If a consumer has a bill (such as an energy or water bill), it is a pre-existing obligation which has to be paid. As such, we are not a BNPL provider as consumers are unable to buy anything on our platform or create any new debts.

If a customer misses a payment to Deferit, the platform prevents any further bills from being uploaded until this is rectified. Our service cannot be used to “kick the can down the road” as the four installment payments are due on a 14 day cycle.

Traditional finance providers are under no obligation to assess the suitability of the transactions the customer is entering into today, even when currently paying off balances accruing high interest charges. These products only assess suitability at the time of application (which can be years before) and not when entering into the transaction.

We assess the suitability of our users in relation to each specific bill they defer. Our goal is to help people avoid falling into debt traps, paying interest and fees that often come with traditional products.

Deferit was created to help people budget better and provide an innovative solution for more flexible and easier bill management. To date, we’ve helped our customers manage over $200 million in bills — giving them more control, flexibility, and peace of mind.

Customers love us as their ongoing bill budgeting tool, with over 74% of our customers using us for more than one bill. We’re reinforcing positive budgeting behaviour and saving people money in the process.